Trading has evolved into a fascinating and potentially lucrative endeavor that attracts individuals from all walks of life. Whether you’re interested in stocks, forex, commodities, or cryptocurrencies, trading offers opportunities to grow your wealth and achieve financial independence. In this comprehensive article, we will delve into the world of trading, covering strategies, tips, and frequently asked questions to help you navigate this exciting field.

The Basics of Trading

What Is Trading?

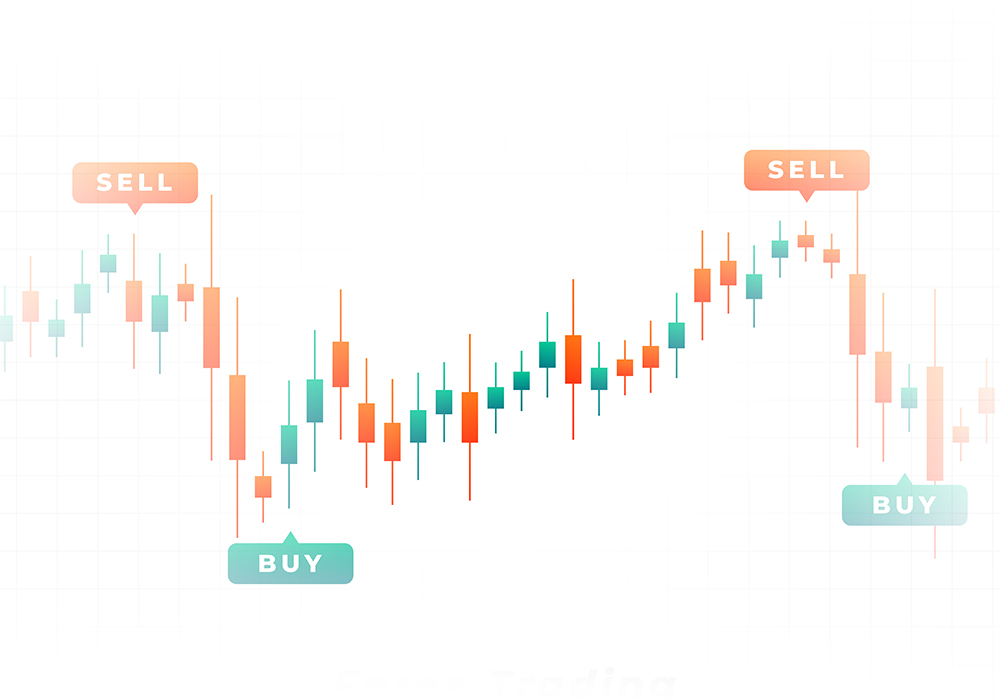

Trading is the act of buying and selling financial assets such as stocks, currencies, commodities, and cryptocurrencies with the goal of profiting from price fluctuations. Traders aim to buy low and sell high (or sell high and buy low in the case of short-selling) to generate profits. It is a dynamic and fast-paced endeavor that requires a solid understanding of markets, analysis, and discipline.

Types of Trading

There are various types of trading, including:

- Day Trading: Day traders buy and sell assets within the same trading day. They often make multiple trades in a single day, aiming to profit from short-term price movements.

- Swing Trading: Swing traders hold positions for several days to weeks, capitalizing on intermediate-term price trends.

- Position Trading: Position traders take long-term positions, holding assets for weeks, months, or even years. They rely on fundamental analysis and macroeconomic trends.

- Scalping: Scalpers make quick, small trades to profit from minor price fluctuations. They often execute hundreds of trades in a single day.

- Options Trading: Options traders buy and sell options contracts, which give them the right (but not the obligation) to buy or sell an underlying asset at a predetermined price.

Trading Strategies

Technical Analysis

Technical analysis involves analyzing historical price charts and using various indicators to predict future price movements. Common technical indicators include moving averages, Relative Strength Index (RSI), and Bollinger Bands. Traders who use technical analysis often look for patterns, trends, and support/resistance levels to make trading decisions.

Fundamental Analysis

Fundamental analysis involves evaluating the financial health and performance of an asset or company. This approach considers factors like earnings reports, economic data, and geopolitical events to determine the intrinsic value of an asset. Fundamental traders seek to buy undervalued assets and sell overvalued ones.

Risk Management

Effective risk management is crucial in trading. It involves setting stop-loss orders to limit potential losses and position sizing to control the amount of capital at risk in each trade. Traders should never risk more than they can afford to lose.

Trading Psychology

Trading psychology plays a significant role in success. Emotions such as fear and greed can cloud judgment and lead to impulsive decisions. Discipline, patience, and emotional control are essential traits for traders.

Diversification

Diversifying your trading portfolio means spreading your investments across different assets or markets to reduce risk. Diversification can help protect your capital in case of adverse price movements in a single asset.

Trading Tips

- Education is Key: Invest time in learning about the markets, trading strategies, and risk management. Continuous education is vital for success.

- Start Small: If you’re new to trading, begin with a small amount of capital. As you gain experience and confidence, you can gradually increase your investments.

- Keep Emotions in Check: Emotional decisions can lead to losses. Stick to your trading plan and avoid impulsive actions.

- Stay Informed: Stay updated on news and events that can impact the markets. Economic releases, earnings reports, and geopolitical developments can all influence prices.

- Practice with a Demo Account: Most brokers offer demo accounts where you can practice trading with virtual money. It’s a risk-free way to hone your skills before trading with real capital.

Trading FAQs

1. How much money do I need to start trading?

- The amount of capital required varies depending on the market and your trading style. Some brokers allow you to start with as little as $100, while others may require more substantial investments. It’s essential to assess your financial situation and risk tolerance before deciding how much to invest.

2. Can I trade part-time while holding a full-time job?

- Yes, many traders engage in part-time trading while maintaining other occupations. It’s important to find a balance that suits your lifestyle and commitment level. Day trading, for example, requires more time and attention than swing or position trading.

3. What are the most common mistakes new traders make?

- New traders often make the mistake of overtrading (making too many trades), neglecting risk management, and letting emotions dictate their decisions. It’s crucial to have a well-defined trading plan and stick to it.

4. Is trading suitable for everyone?

- Trading can be suitable for individuals with the right mindset, discipline, and risk tolerance. It’s not a guaranteed way to make money, and losses are a part of the game. Before starting, assess your financial goals and willingness to learn and adapt.

5. What are the tax implications of trading?

- Tax laws related to trading vary by country and can be complex. In some jurisdictions, profits from trading may be subject to capital gains tax. It’s advisable to consult a tax professional or accountant to ensure compliance with local tax regulations.

In conclusion, trading offers a world of opportunities to those willing to invest time, effort, and capital into mastering the art. Whether you’re a novice or an experienced trader, continuous learning and disciplined execution of strategies are key to success. By following these tips and staying informed, you can navigate the markets with confidence and potentially achieve your financial goals through trading.