In the vast realm of financial markets, indices trading stands out as a popular and lucrative option for traders seeking diversification and exposure to broader market movements. Indices represent a basket of stocks or assets, and trading them can provide opportunities for profit, risk management, and portfolio diversification. In this comprehensive guide, we will delve into indices trading, exploring various aspects, including strategies, risks, and frequently asked questions.

Understanding Indices Trading

What Are Indices?

Indices, often referred to as indexes, are financial instruments that represent a specific group of stocks or assets within a market. They serve as benchmarks, measuring the performance of a particular sector, industry, or the overall market. Prominent indices include the S&P 500, Dow Jones Industrial Average (DJIA), NASDAQ Composite, and FTSE 100, each representing a different segment of the stock market.

Why Trade Indices?

Trading indices offers several advantages:

- Diversification: Indices provide exposure to a broad range of stocks, reducing the risk associated with individual stock trading.

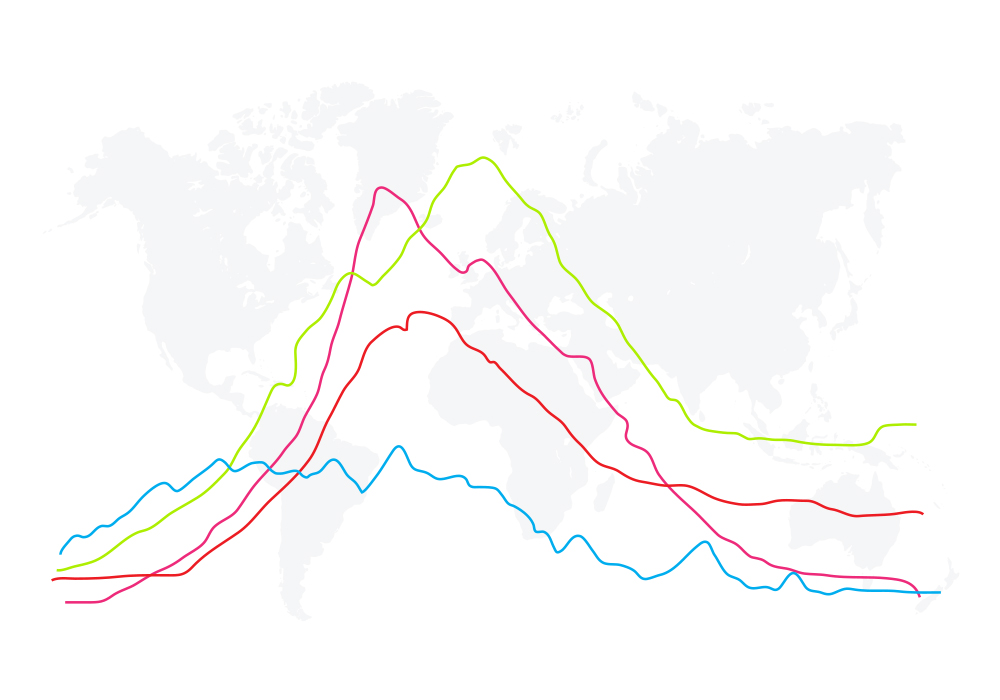

- Market Performance: Indices track the overall market sentiment, making them valuable tools for gauging market health and trends.

- Liquidity: Major indices are highly liquid, allowing traders to enter and exit positions easily.

- Accessibility: Indices can be traded through various financial instruments, including futures contracts, exchange-traded funds (ETFs), and options.

- Risk Management: Indices trading allows hedging against portfolio risk, providing a cushion during market downturns.

Strategies for Trading Indices

Trading indices involves a variety of strategies, catering to different trading styles and risk tolerances. Here are some common strategies:

- Day Trading: Day traders aim to profit from short-term price movements within a single trading day. They use technical analysis and closely monitor intraday charts to make quick, high-frequency trades.

- Swing Trading: Swing traders hold positions for several days to weeks, capitalizing on medium-term price swings. They rely on both technical and fundamental analysis to identify entry and exit points.

- Trend Following: Trend-following strategies involve identifying and trading in the direction of the prevailing market trend. Traders use moving averages, trendlines, and momentum indicators to guide their decisions.

- Contrarian Trading: Contrarian traders go against the crowd, seeking opportunities when market sentiment is overly bullish or bearish. They believe that markets tend to revert to the mean, and they look for turning points.

- Options Trading: Traders can use options contracts to speculate on or hedge against index movements. Options strategies can be versatile, allowing traders to profit from volatility or generate income.

Risks in Indices Trading

While indices trading offers many benefits, it also comes with inherent risks:

- Market Risk: Indices are susceptible to market fluctuations, and unforeseen events can lead to significant losses.

- Leverage: Some trading methods, like futures and options, involve leverage, which can amplify gains but also magnify losses.

- Lack of Diversification: Although indices provide diversification, some traders might concentrate their portfolios on a single index, increasing risk.

- Volatility: Market indices can experience periods of extreme volatility, which can lead to rapid and unpredictable price movements.

- Overtrading: Excessive trading or trading without a clear strategy can result in losses due to high transaction costs.